Accelerate your marketplace sales globally

Effortlessly grow your international sales on eBay and Amazon in over 30 countries with Webinterpret’s end-to-end cross-border solutions

2 billion+ USD

incremental cross-border trade GMV generated for sellers and marketplaces

40,000+

independent sellers worldwide

16+ years

of enabling cross-border business

For eBay sellers

Boost your global sales on eBay

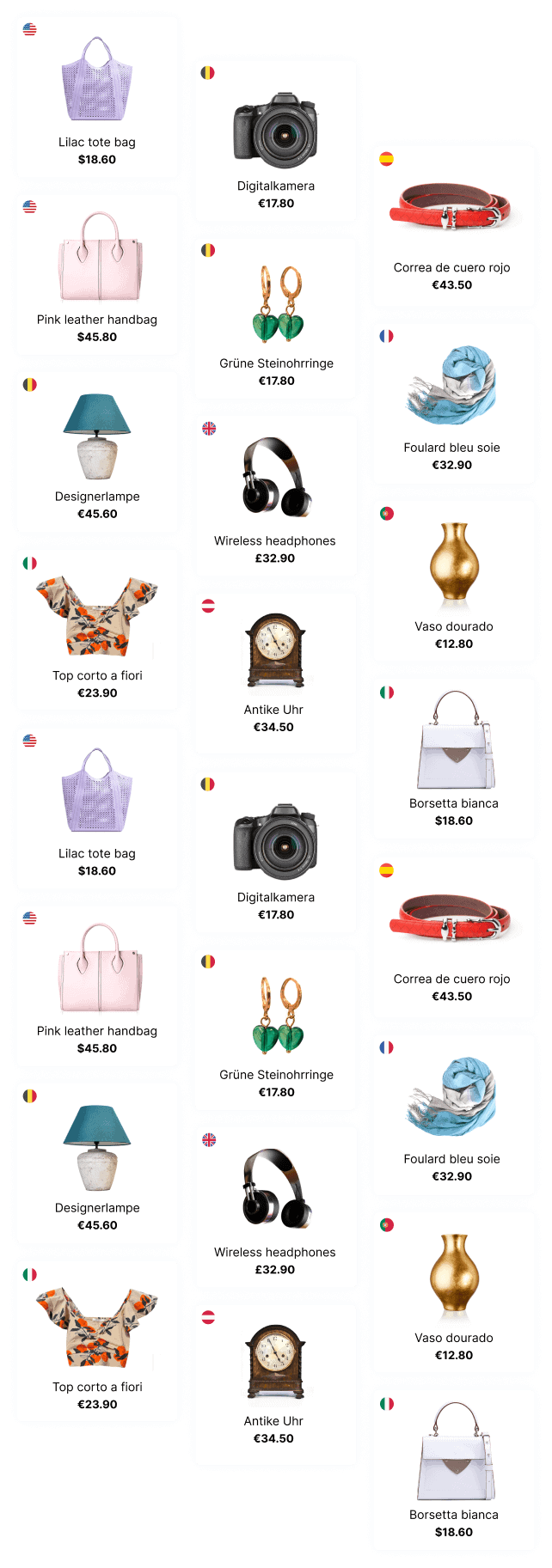

Webinterpret increases your visibility, traffic and conversion on international eBay marketplaces in just a few clicks.

For Amazon brands

Unlock new markets on Amazon

Webinterpret accelerates your brand’s growth on untapped Amazon marketplaces with international visibility and local order fulfillment.

For eBay sellers

Boost your global sales on eBay

Webinterpret increases your visibility, traffic and conversion on international eBay marketplaces in just a few clicks.

For Amazon brands

Unlock new markets on Amazon

Webinterpret accelerates your brand’s growth on untapped Amazon marketplaces with international visibility and local order fulfillment.

Meet the Webinterpret service portfolio: tools designed to scale your business

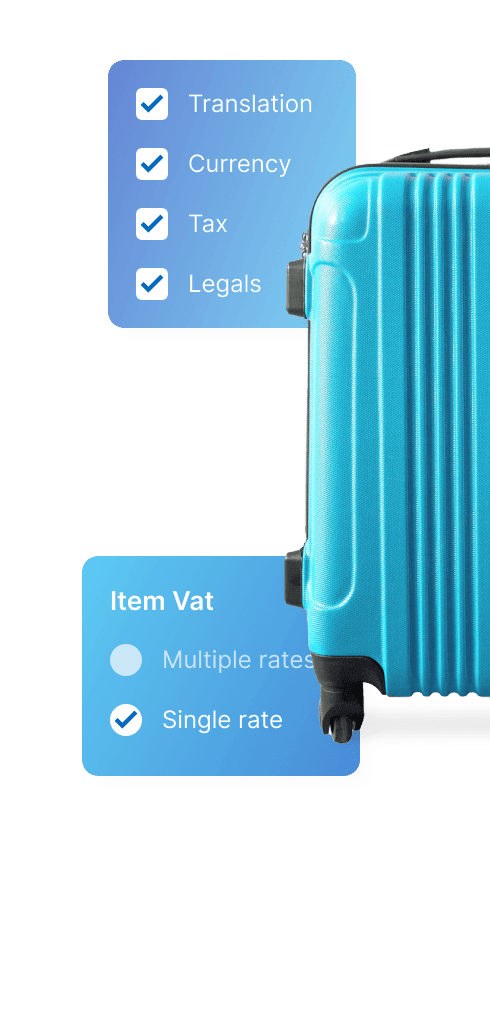

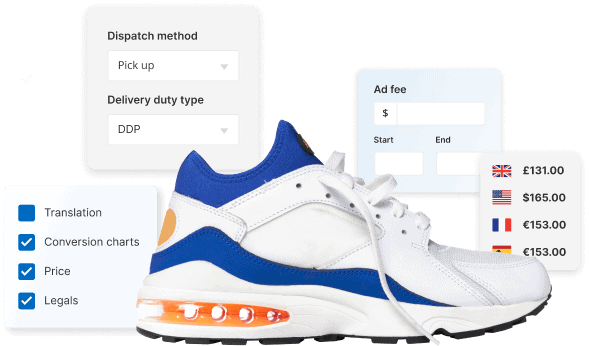

Internationalization

Offer a seamless local shopping experience, reach more buyers globally, and increase your sales in just a few clicks.

Advertising

Make your items stand out from the billions of listings on marketplaces with Webinterpret’s AI-powered advertising solution.

Logistics

Streamline your shipping process and grow your buyers’ confidence with a seamless free returns experience.

Tax & Compliance

Ensure taxes are declared to local authorities and local compliance is met every step of the way.

Branding

Build brand recognition, increase buyer conversion and stand out from the competition with Creative & Content services.

With Webinterpret international sales began almost immediately after signing up for the service. Rather than potential buyers numbering in the millions, they now number more than a billion.

Troy Shockley

Mountain Man Treasure

Get started now

Explore the possibilities of expanding into international marketplaces today. Start your free trial now!

- Connect your store

Webinterpret’s AI-powered intelligence takes care of the rest - Grow your business

Double your international revenue

Benefits of global selling for your business

Selling on international marketplaces offers numerous advantages

3,600 m€

2023 value of all marketplaces

71%

of US and European shoppers shop internationally

54%

of marketplace sales account for global ecommerce

Connect your store

Connect your store

Grow your business

Grow your business

Get started now

Get started now